Gross up formula

On the IRS Form 1042-S issued to the student the full amount of 116279 will be reported. The formula for calculating the total amount of a grossed-up payment is the amount of the payment divided by 1 minus the tax rate.

Net To Gross Calculator

Thus a 10000 payment to a recipient who has a.

. Calculation of GP for B Ltd can be done as follows. You have to gross up first. Grossed-Up 338h10 Adjustments has the meaning specified in Section 412div.

Its taxable expenses divided by. Gross-up FAQ What is gross pay. Its unfair to directly compare a stock paying fully-franked dividends with one paying unfranked or partly franked dividends.

Use this federal gross pay calculator to gross up wages based on net pay. EXAMPLE Net interest is 100 and the tax rate is. Under the Tax Act such dividends deemed to be received by an individual other than certain trusts will be included in computing the individuals income for tax purposes and will be.

The condition was that the gross profit should be 10 of the contractors size and. GROSS AMOUNT Net amount divided by 1-grossing-up rate A common example is grossing up interest for income tax or withholding tax. Has the meaning specified in Section 412div.

So how do you do a gross-up calculation. The grossing-up fraction is 100. Multiply the percentage in decimal form times the net figure.

Correctly drafted a gross up provision relates only to Operating Expenses that vary with occupancyso called variable expenses. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross. How Do You Calculate Gross-Up.

This might include federal income tax. Gross Profit will be 35000000 34184500. In order to convert a percentage to a decimal divide by 100.

To calculate 500 bonus grossed-up follow these four steps. If the withholding tax rate is 10 the grossing up formula is. This gross-up calculator is designed to help you figure out how much you need to pay an employee if you want them to take home a specific amount of money after taxes are withheld.

So the formula is taxable expenses divided by one minus the sum of the tax rates equals your gross-up plus your expense. A gross-up clause is one that makes it clear that A has to pay such further sum as after deducting any tax leaves B with 100. Grossed up dividend.

Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit. In this example you. Gross pay is how much an employee earns before any deductions which could include taxes child support payments health care plan.

The calculation is as follows. Add up all the tax rates that apply to the employees wages. Add together all applicable tax rates which are Federal Supplemental tax rate 22 Social.

If you know the net income and want to find the gross income you re-arrange the above to make gross income the subject of the equation ie divide the net income by 08 - notice this is. 3 Tax Gross-Up Formulas Examples Formula 1 The Flat Method. The flat method uses a flat percentage calculated on the taxable expenses and then added to the.

Multiply the net amount received by the grossing-up fraction. Typically a gross-up provision will kick in when the average occupancy for the year falls below a certain percentage. The process of calculating this gross figure is called grossing up.

Variable expenses are those expenses that will go. It only takes a few simple steps. So lets rewind and do that again.

If you divide 70 by 100 you get 070. Typically this percentage is below 95 to 100. Stipend amount 10 tax rate Total stipend payment 10 - 14 tax.

What Is Gross Up Tax Gross Up Formula Definition Caprelo

What Is Gross Up Tax Gross Up Formula Definition Caprelo

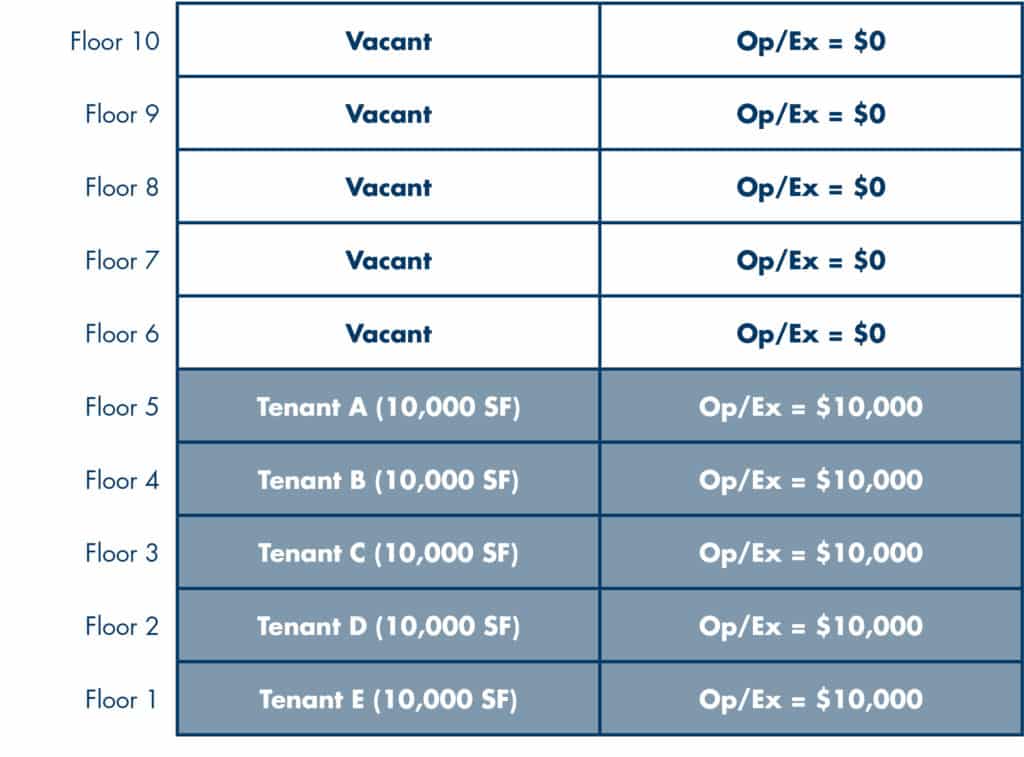

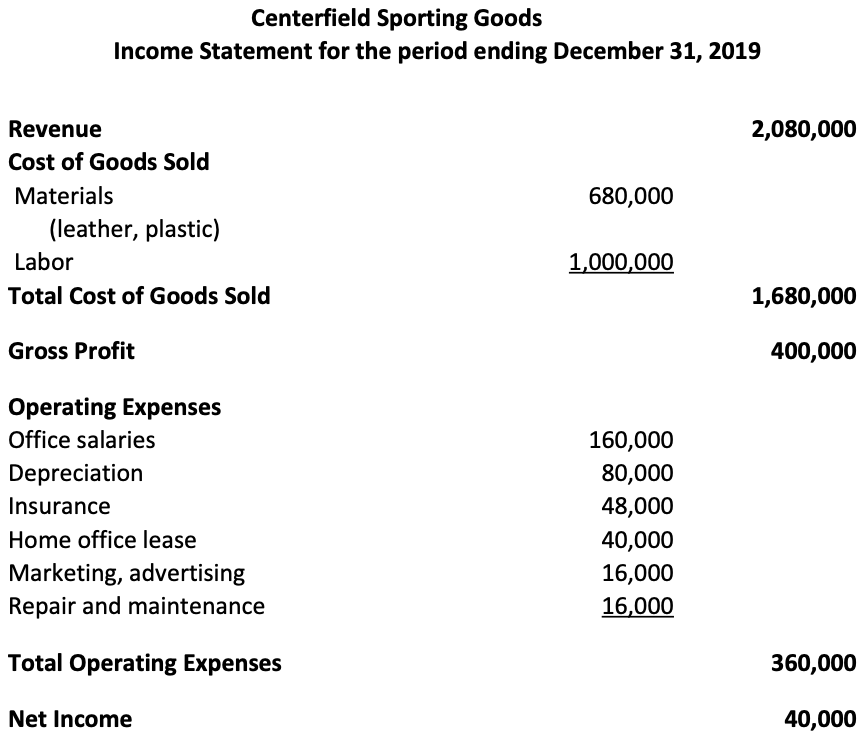

What Is An Operating Expense Gross Up Provision In A Lease

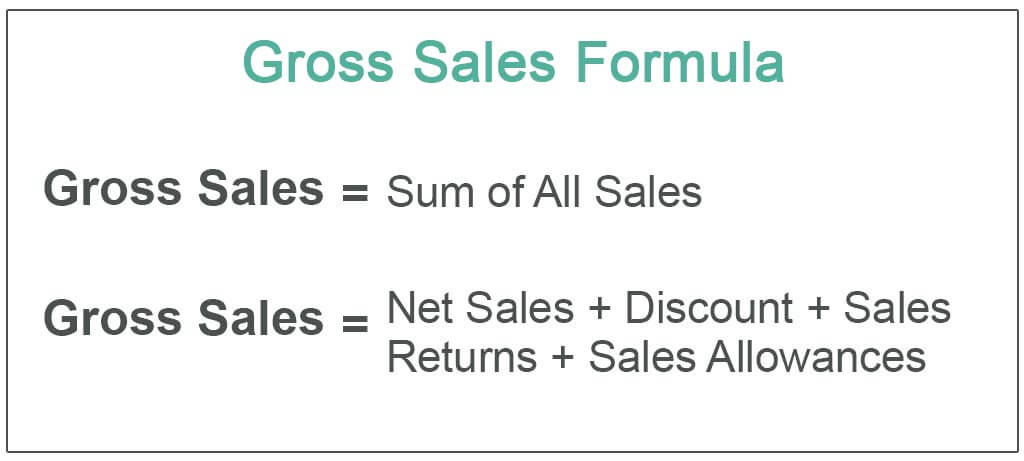

Gross Sales Formula Step By Step Calculation With Examples

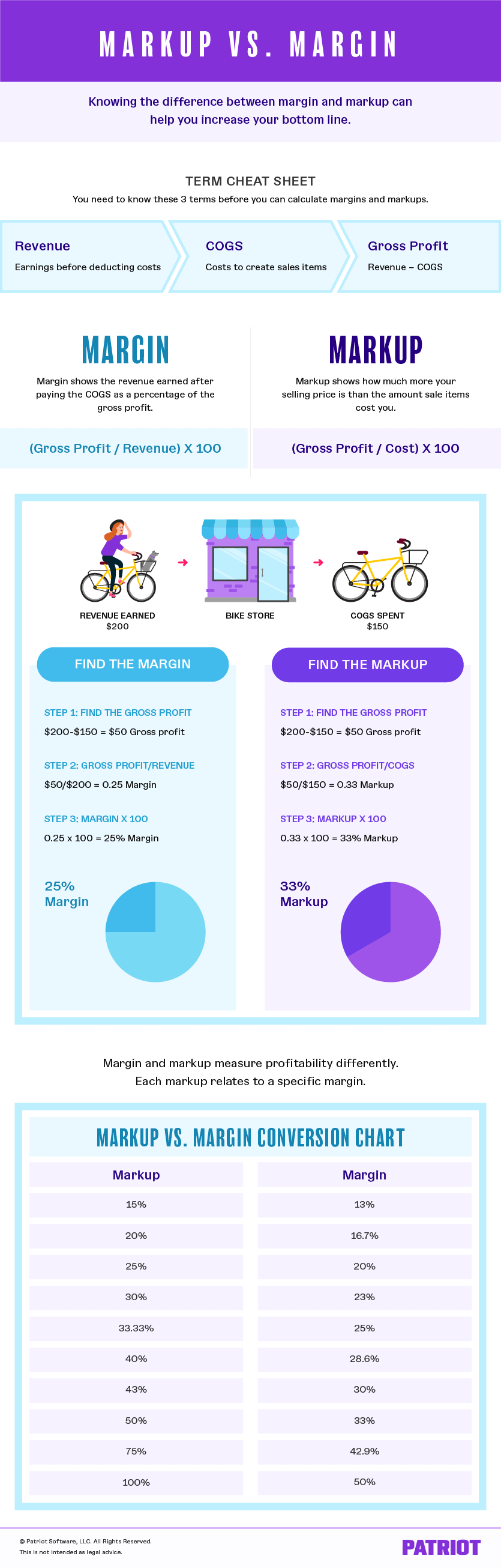

Margin Vs Markup Chart Infographic Calculations Beyond

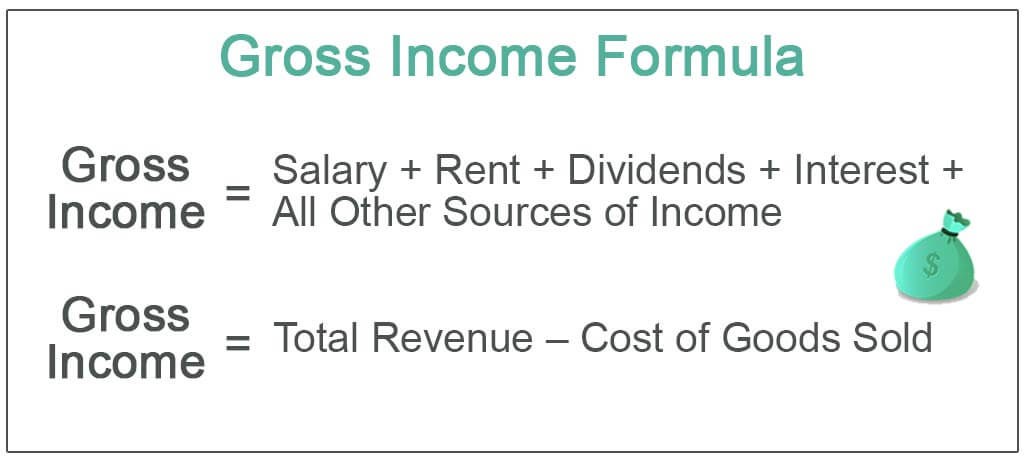

Gross Income Formula Step By Step Calculations

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Gross Income Formula Step By Step Calculations

Markup Vs Gross Profit Percentage The Beancounter

Gross Sales Formula Step By Step Calculation With Examples

Gross Income Formula Step By Step Calculations

What Is An Operating Expense Gross Up Provision In A Lease

What Is Gross Margin And How To Calculate It Article

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Profit Margin Formula And Calculator

How To Calculate Gross Income Per Month